With more than 267 million acres of farmland across the region, few assets rival the potential of the Midwest. The Midwest has some of the largest and most lucrative investment opportunities in the world. This isn’t solely due to how much land it has but also because of its fertile soil, consistent yields, and long-term value.

In this article, you’ll discover why investors, lenders, and land buyers choose farmland in the Midwest when they’re looking for revenue-generating opportunities.

The True Value of Farmland in The Midwest

With generations of farming and some of the most productive soil in the world, the Midwest has solidified its place as the foundation of U.S. agriculture. That fruitful history, paired with a climate suitable for consistent crop yields, makes the region’s farmland both resilient and reliable.

Farmland in the Midwest thrives because of:

- Fertile, high-quality soil that supports strong crop production

- Climate stability with predictable rainfall and growing seasons

- Historical appreciation that outperforms traditional assets

- Strong demand from experienced farmers for leasing and operations

With these natural advantages in place, what’s the actual income potential? Let’s look at how Midwest farmland generates consistent returns.

Income Potential for Midwest Farmland for Sale

Whether through direct crop production or leasing arrangements, Midwest farmland delivers consistent, year-over-year income.

Those income drivers are supported by three key factors:

1. Soil Quality and Crop Productivity

Midwest farmland is known for its rich, well-drained soil, especially in states like Iowa and Illinois, which helps grow high-yield crops like corn and soybeans.

2. Market Demand and Commodity Prices

Steady demand for food, biofuels, and exports helps sustain strong pricing and rental rates that boost annual returns.

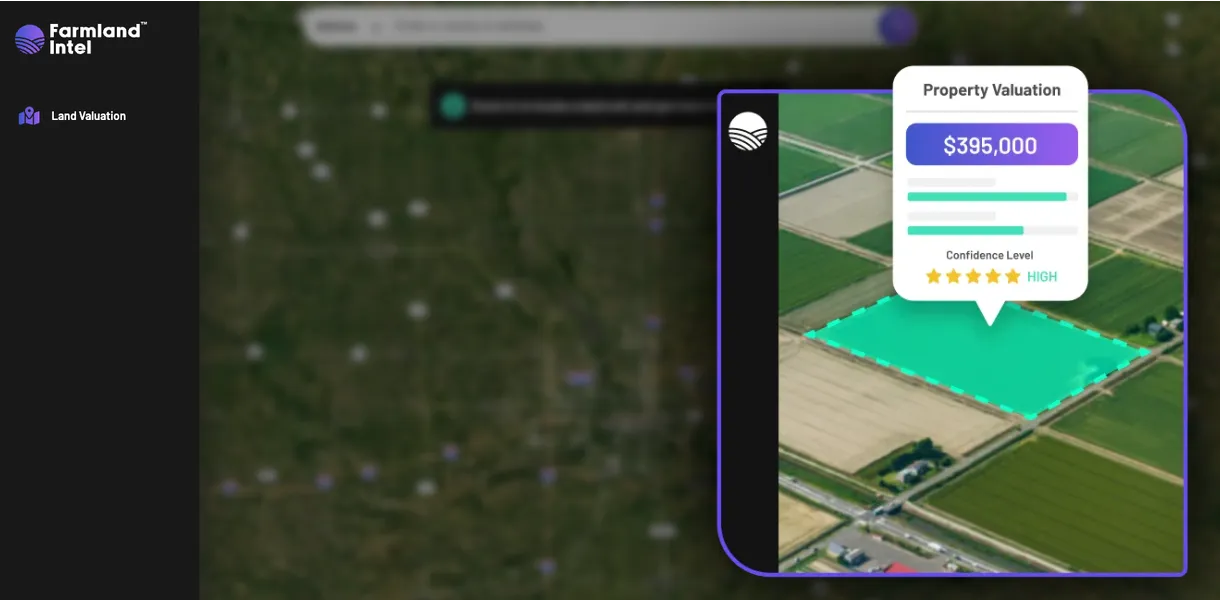

3. Access to Technology and Data Tools

Platforms like Farmland Intel help investors assess soil health, comps, and yield forecasts that help investors make smarter purchases and better manage the land.

Finding land that offers the most returns takes more than choosing a prime location; it requires a deeper dive into data. Farmland Intel specializes in evaluating Midwest farmland, combining real-time data, verified comps, and regional expertise that empowers you to make profitable decisions.

Whether you’re investing, lending, or selling, Midwest farmland offers proven performance. Land valuations from Farmland Intel identify top-producing properties backed by trusted data.