Make Informed Decisions with Accurate Farmland Data

Ensure Confidence in Your Loan Portfolio with Expert Land Valuation and Analysis

Why Leading Institutions Trust Farmland Intel

There is always risk involved when a lender accepts land as collateral for a loan. Land values can fluctuate based on market trends and even environmental issues and events. A land valuation report and analysis from Farmland Intel minimizes that risk and allows your institution to make the most informed and secure decision when it comes to this type of investment.

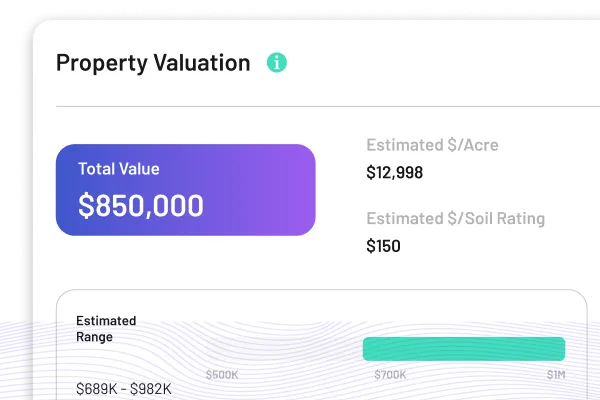

With data-driven land valuation from Farmland Intel, leading lending institutions feel confident knowing they have the insight they need to accurately assess risk and make the smartest loan decisions. A Farmland Intel land valuation report offers valuable information on the land’s potential which can dramatically impact its market value. It also helps lenders compare the land to similar properties while informing decisions on loan structure, payment terms, and any additional financing needs.

Accurate Land Valuation for Reliable Loan Assessments

Know the True Value of Your Farmland Investment

A clear, detailed and accurate land valuation from Farmland Intel will help investors understand the potential profitability and long-term growth of farmland assets. With informed data on climate, water sources, and crop value, investors are empowered to make informed decisions that can optimize their success.

Invest in High-Quality Land with Proven Crop Yields

An expert assessment of soil types, erosion risk, and historical crop yields bring clarity to the value of farmland investments, as well as:

- Identifies premium soil types for sustainable crop production.

- Leverages historical crop data to forecast future income potential.

Stay Ahead of the Market with Real-Time Data

Real-time data examines comparable sales and market trends to help investors identify high-potential farmland. Additionally, this information assists investors in the timing of their purchases or sales in order to maximize profits and take advantage of high-growth market opportunities.

Ensure Confident and Informed Lending Decisions

Comprehensive land valuation reports for accurate loan assessments. Detailed soil and crop analysis to evaluate the productivity of collateral. Market trend data for understanding asset appreciation potential.

Environmental risk mapping to minimize loan risk.

Minimize Risk with Detailed Environmental Insights

Ecological factors and environmental events such as drought, flooding, tornadoes, plant diseases, insect infestations and more can pose a risk when investing in farmland. That’s why it’s critical to receive a land valuation report to determine:

- Flood zone mapping which helps you assess potential risks to the collateral.

- Topographical data for understanding land suitability and potential development challenges.

Having all the relevant and critical information that a land valuation report delivers will help you make the best possible and most well-informed decisions that incorporate risk mitigation strategies.

Support Loan Performance with Reliable Data

Knowing what to expect from loan performance is valuable to an institution in determining future land investments. A land valuation report from the expert appraisers at Farmland Intel will provide you with:

- An informative review of past crop yields to project borrower revenue.

- Current state and regional price trends to inform lending strategies.

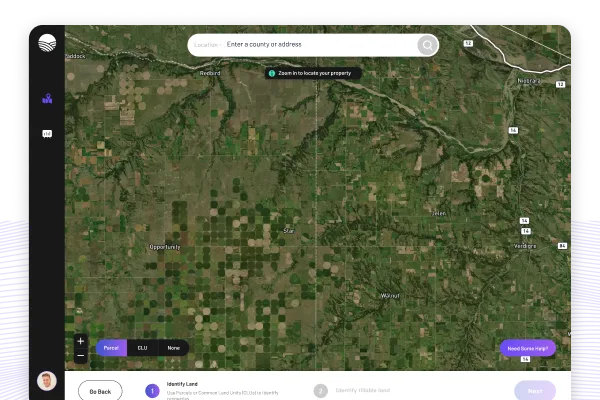

Simple Process for Comprehensive Lending Analysis

The process for obtaining a comprehensive lending analysis of your prospective investment is easy.

Simply follow these steps and get the data you need for sound lending